Settling sales tax in Dynamics 365 for Finance and Operations

At the end of the month you not only need to be able to calculate the sales tax due to each state in which you have jurisdiction, but you also need to enter an invoice and/or payment for the transaction. In Dynamics 365 for Finance and Operations, you can do both in one process by settling your sales tax.

To do this, go to Tax > Declarations > Settle and post sales tax.

This will open the Settle and post sales tax flyout. In this window, you will need to select the information for the period you are reporting. In settlement, you will select your settlement period. This corresponds to the state and usually is monthly. However, depending on the state in which you report, it could be quarterly.

The Transaction date corresponds to the date you submit the payment to the revenue department. The From date is the first date of the month for which you are reporting, or the first date of the quarter if you report quarterly. When these boxes are filled, click OK.

Select the destination and click OK.

This will generate the report that was settled for sales tax, which includes the taxable amount for each tax code, as well as the sales tax amount.

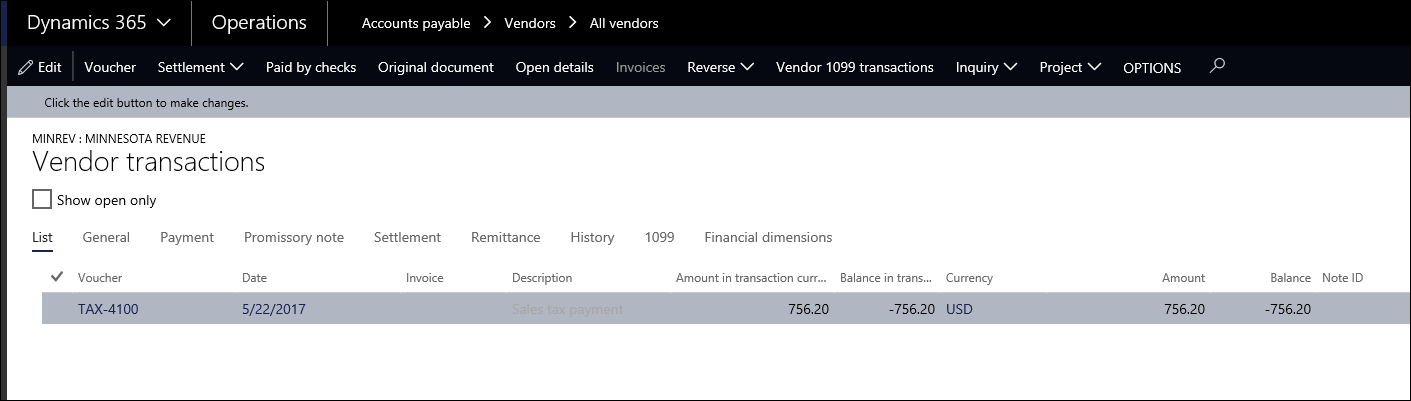

This also creates an invoice for your sales tax authority so that you will have a transaction to which you can apply your payment.

Note: If the state you are reporting to rounds to the nearest dollar for each of your tax jurisdictions, there may be a slight difference between the invoice amount on the sales tax authority vendor and the amount paid to the department of revenue. To clean this up you can enter a correcting amount invoice under that vendor to apply the remaining payment amount. This may be something you can do on a monthly or quarterly basis.