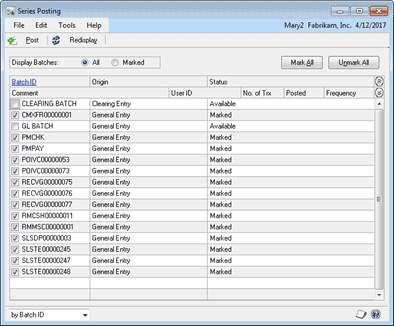

What Do You Do if Your Checkbook and Cash Accounts Do Not Balance?

When your Checkbook and Cash Account do not tie, it can be frustrating to figure out what has caused the discrepancy. There are a couple quick things to check before you start any time consuming research into the difference.

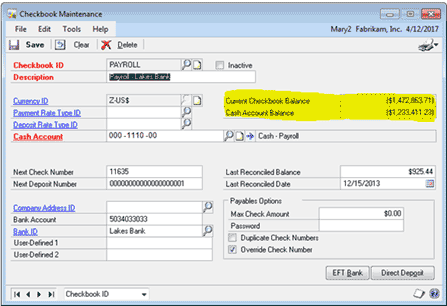

The first thing you will want to check is that everything has been posted through Series Post. If you have transactions sitting in Series Post, this may account for all or part of the difference. To check Series Post go to Financial > Transactions > Series Post. Mark next to any unposted transactions, but watch for any monthly or recurring batches. You will want to make sure these are unmarked before you post the rest of the transactions.

After you post these transactions, you will want to check the Checkbook Card to see if there has been a change in the difference between the checkbook and cash account balance.

The second thing you will want to check is whether or not there are any outstanding cash receipts that have not been deposited. You can check this by going to Financial > Transactions > Bank Deposits. Bring up the checkbook and see if there are any cash receipts to be deposited. Click Mark All to get the total amount. If this amount is the difference between your checkbook and your cash account, you have found the cause of the difference.

This difference between the Cash Account and Checkbook happens when there are un-deposited cash receipts. When a cash receipt is entered, it debits your cash account. However, it does not hit the checkbook until it is deposited. After you make the deposit, the two numbers should tie. After each deposit you make going forward, make sure to verify that the Checkbook and Cash Account balance.

If there is still a variance after taking into account the outstanding deposits, you will need to compare the GL and Checkbook Balance to find what is causing the difference.

Typically what will cause the difference are GL transactions that directly hit the Cash Account without going through any other module, like Accounts Receivable, Accounts Payable, or the Checkbook. This means that the transaction affected the cash account, but did not touch the checkbook.

Another cause is that the transaction went through one of these other modules, but the distribution of the account was incorrect, and went to the wrong GL. While this is not a usual occurrence, it can happen.

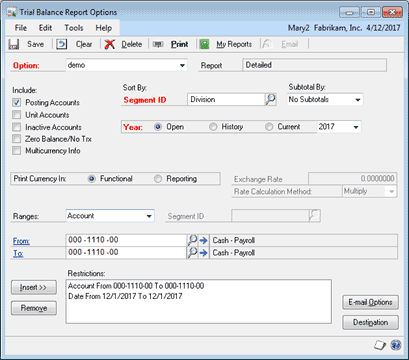

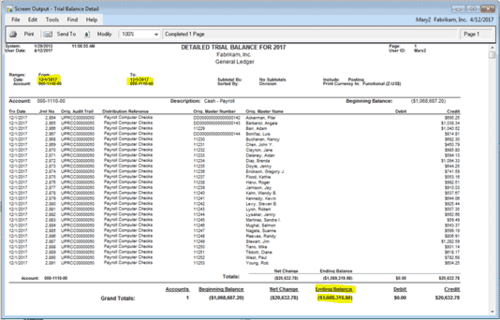

To find the what is causing the difference between the Checkbook and Cash Account, you will need to compare the GL Trial Balance and the Checkbook Balance. Bring up the Detailed Trial Balance by going to Financial > Reports > Trial Balance. Set the restrictions for the report for the Cash Account and a date you know it last balanced.

For the Checkbook Inquiry, go to Financial > Inquiry > Checkbook Balance. You can enter the same date restrictions as the Detailed Trial Balance. To compare to the GL Trial balance you will compare the balance of the last transaction for a date in the Checkbook Inquiry to the Ending Balance of the Trial Balance Report.

After you find when they last tied, you will need to narrow down when the accounts when out of balance. You can do this by entering a new date and comparing the balances. I suggest a month after the last time it balanced. If it balanced on January 1st 2013, the next date you would check is February 28th 2013.

If it balances for that date, go to the next month end date and so forth until you reach a month end date that doesn’t match. When you reach that point, you will need to narrow down what day during the month the balance went off.

You can do this by checking the first through the 15th of the month, if that ties, check the 15th through the end of the month. Keep narrowing the date range until you find the date that the balance stopped matching.

Once you narrow it down to a specific date, you will want to compare the checkbook transactions for that day to the GL transactions for that day. If there are transactions that are missing from one but are in the other, those transactions are what is causing the difference.

Once you have found what is causing the difference, you will need to enter correcting entries. If it is something that was entered in the GL but not the checkbook, you will need to reverse the GL entry, and enter it correctly in Purchasing, Sales, or Checkbook.

If it was in the checkbook and not the GL, you will need to void or reverse the entry that has the incorrect distribution, and re-enter the transaction with the correct distribution. After all the corrections have been made, verify that the Checkbook and Cash account now balance.

This process is for reconciling the Checkbook and Cash Account in GP 2010 and prior. In GP 2013 there is the ability to use Reconcile to GL for Bank Reconciliation. This is a new feature that will hopefully eliminate this process as it can be time consuming. In another blog post I will review this feature and go through how to use it.